China Sanctions 7 Firms | Miran Tapped for CEA | Senate: BIS Enforcement Lacking

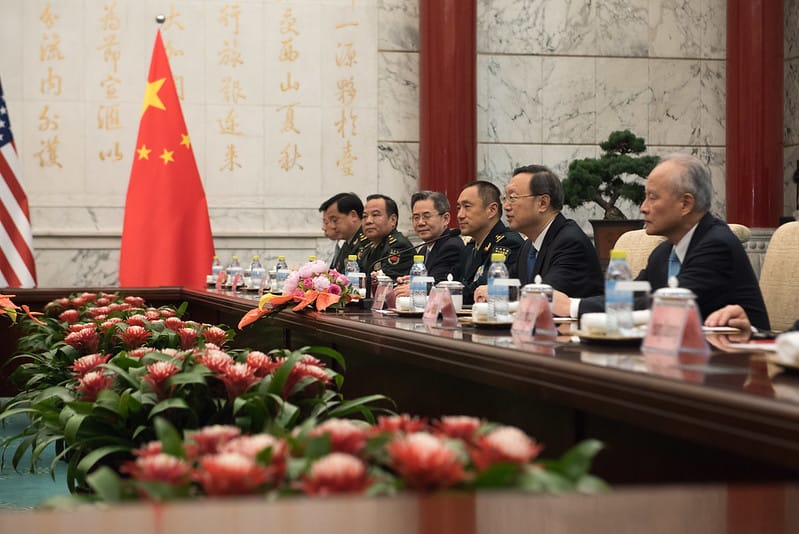

China Sanctions 7 U.S. Companies and Executives Over Arms Sales to Taiwan

China has banned Chinese companies or individuals from doing business with seven Western defense firms. The sanctioned companies are Insitu Inc., Hudson Technologies Co., Saronic Technologies, Inc., Raytheon Canada, Raytheon Australia, Aerkomm Inc. and Oceaneering International Inc. The sanctions also included "relevant senior executives," who were not named.

The sanctions are a response to the U.S.'s recent announcement of $571 million worth of aid to Taiwan, in addition to $295 million in sales of military equipment that were approved by the U.S. Department of Defense.

They also come on the heels of China's sanctioning of another 13 U.S. defense contractors several weeks ago, along with executives of Raytheon, BAE Systems and United Technologies, after the U.S. gave the green light for the sale of $385 million worth of spare parts to Taiwan for its F-16 fleet.

Our analysis: U.S. aid to Taiwan is miniscule compared to the total defense budget signed last Monday, which authorized a total of $895 billion. It also pales in comparison to Biden's latest $5.9 billion tranche of aid to Ukraine, part of an 11th hour surge of assistance before Trump takes office.

The financial impact of China's sanctions is minimal. Most Western defense companies don't do business with China.

However, China's leaders know it is entering into what will likely be a contentious period with the incoming Trump administration. Because China runs a trade surplus with the U.S., it has fewer metaphorical tariff "bullets" it can fire in a potential trade war - the value of U.S. exports to which it can apply tariffs is significantly smaller than the value of Chinese exports to which the U.S. can apply tariffs.

As a result, China is accelerating its evaluation and deployment of asymmetric responses to potential U.S. tariffs and export controls. Its use of sanctions in particular foreshadows Beijing's long-term goal of developing an extraterritorial sanctions regime akin to the one currently brandished by the U.S. Once realized, this will further increase pressure on unaligned countries and companies to choose sides between China and the United States, aligning with one and forsaking markets and supply chains in the other.

Additional reading: Reuters, AP, SCMP

Miran Picked to Lead Trump's Council of Economic Advisors

President-elect Trump announced on Truth Social that he intends to nominate Stephen Miran to lead the Council of Economic Advisors (CEA). The CEA is tasked with analyzing and interpreting economic data and events and providing recommendations to the President based on "sound economic policy."

Miran served in the first Trump administration at the Treasury Department as senior advisor for economic policy under Secretary Steven Mnuchin. Since leaving Treasury, he's worked as a fellow at the conservative-leaning think tank Manhattan Institute and as a senior strategist for hedge fund Hudson Bay Capital Management LP.

Our analysis: Fortunately for political analysts everywhere, Miran's roles as an investment strategist and commentator have generated plenty of literature framing his likely policy positions during Trump's second term.

Miran has been a vocal critic of the Federal Reserve, arguing in October of this year that "the wall between fiscal and monetary policy is already partially broken down, and the central bank’s independence is overstated."

In March, he co-authored a report for the Manhattan Institute claiming that "[t]he Federal Reserve’s record in recent years raises questions about whether it has been operating in line with the best practices of central bank independence" and citing instances of politicized behavior or actions taken by the Fed.

These accusations gained enough traction for Treasury Secretary Janet Yellen to be forced to directly address them during an interview with Bloomberg News.

Miran's arguments that the Fed is already a de facto political institution are well-aligned with President-elect Trump's statements that the Fed should be subject to greater direction from the President.

Miran is also a tariff hawk. He's argued that it's "[b]etter to take tariffs from low levels higher, than corporate or income [tax rates] from already-high to even-higher."

The notion that we can just magically have a government and national security without raising any revenue is absurd. You need revenue from somewhere.

— Stephen Miran (@SteveMiran) November 14, 2024

Better to take tariffs from low levels higher, than corporate or income from already-high to even-higher

In a commentary for Barron's co-written with Hudson Bay Capital CEO Sander Gerber, he cited data showing that "the tariffs caused the dollar to move higher by close to the exact amount the tariff rate went up, offsetting the tariffs."

He also argued that "economics literature on 'optimal tariff rates' suggests the U.S. would be best off with an effective tariff rate near 20%, far higher than the current 3%. According to Wall Street calculations, Trump’s proposals would bring us close to an effective rate of 17% if enacted in full."

Miran's November 2024 essay titled "A User’s Guide to Restructuring the Global Trading System," hedges that it "is not policy advocacy but an attempt to catalogue the available tools and analyze how useful they may be for accomplishing various goals," but goes on to offer a combination of tariffs and a weaker dollar as remedies for "[t]he deep unhappiness with the prevailing economic order."

This unhappiness, according to Miran, "is rooted in persistent overvaluation of the dollar and asymmetric trade conditions. Such overvaluation makes U.S. exports less competitive, U.S. imports cheaper, and handicaps American manufacturing."

The 41-page essay is worth a read as an economically-grounded defense and implementation roadmap for an America First approach to policy in Trump's second term. One which, by nominating Miran, Trump appears to have endorsed.

Additional reading: Politico, Axios, Manhattan Institute, Bloomberg, Newsweek, Barron's, Hudson Bay Capital

Senate Panel Report: U.S. Export Controls "Strong on Paper, Weak in Practice"

Earlier in December, the majority staff of the Permanent Subcommittee on Investigations of the U.S. Senate Committee on Homeland Security and Governmental Affairs issued a report titled "The U.S. Technology Fueling Russia's War in Ukraine: Examining the Bureau of Industry and Security's Enforcement of Semiconductor Export Controls."

The report was the product of a 15-month investigation in which "the Subcommittee reviewed thousands of pages of documents and data from AMD, Analog Devices, Intel, Texas Instruments, and BIS, and received briefings from representatives from AMD, Analog Devices, Intel, non-governmental organizations focused on tracing the technology utilized in weapons in the Russia-Ukraine war, and current and former government officials at BIS and the Department of State."

The Subcommittee found that the Department of Commerce's Bureau of Industry and Security (BIS), which has oversight of U.S. export control rules and enforcement, has failed to effectively use all of its enforcement authority. It also found that Congress has not adequately funded BIS, despite the emergence of export controls "as one of the United States’ leading tools to advance its geopolitical goals." It explains:

The report offers the following recommendations:

- Congress should provide BIS adequate funding to manage its increased workload and responsibilities.

- BIS should accelerate plans to impose higher fines on companies who violate export controls.

- BIS should charge companies with “knowing” violations when they fail to sufficiently investigate red flags or other strong indicia of potential diversion and violations occur.

- BIS should rely less on voluntary compliance from semiconductor companies and instead mandate specific components an export control compliance program must contain.

- BIS should require periodic, routine reviews of semiconductor companies’export control plans by outside entities.

Our analysis: This report comes at a critical inflection point in U.S. geopolitical strategy. The Biden administration saw a dramatic increase in the use of export controls as one of the main policy tools to counter Russia and China, and the incoming Trump administration will rely heavily on export control rules alongside tariffs as key drivers of its industrial policy agenda.

This means that the list of industries and products subject to export control rules will only continue to grow. However, issuing new rules does little good if existing rules cannot be effectively enforced.

The report's most significant findings are regarding resource constraints. BIS's funding has flatlined since 2010, capping how many analysts it can hire as its workload has increased. And, the agency's IT infrastructure was developed in 2006 and has not been upgraded since then. This profoundly hinders the agency's effectiveness, regardless of how many additional staffers are hired.

The other problems cited by the report, such as lax rules on the required contours and elements of companies' export control compliance programs and BIS's reluctance to pursue end-user checks and enforcement penalties, are downstream from a lack of funds, staff and infrastructure. Fortunately, since export controls have grown from being seen as a critical national security tool to also being an industrial policy instrument, there will likely be bipartisan agreement in Congress on providing additional funding.

Whether the report will result in an overhaul of export compliance rules is yet to be seen, but Trump's incoming administration will likely make even greater use of export controls than Biden did, which will result in political pressure for better risk management and patching of gaps in enforcement, as well as funding to enable the necessary changes.

The next four years will see a broader range of products become subject to export controls. Companies' compliance responsibilities, along with the penalties for failing to carry them out, will become steeper. Firms that do not see themselves as trading in sensitive technology today may find themselves suddenly needing to invest in robust export compliance programs and experts tomorrow.

Additional reading: The Subcommittee's Report

Does your company have questions about what Trump 2.0 will bring? Trying to reduce political and geopolitical risk in your strategic planning? Want to develop greater resilience to geopolitical shocks? We can help. Click here to send us an inquiry.