US and EU Negotiators Race to Finish Trade Deal Before Deadline

President Trump's July 9th deadline for trade deals is a week away, and US and EU negotiators remain far apart on key issues. Both parties may slap each other with retaliatory duties if negotiators cannot agree on a framework for further talks by the deadline. However, such an escalation would be short-lived; constraints on both the US and EU favor an eventual return back to the negotiating table.

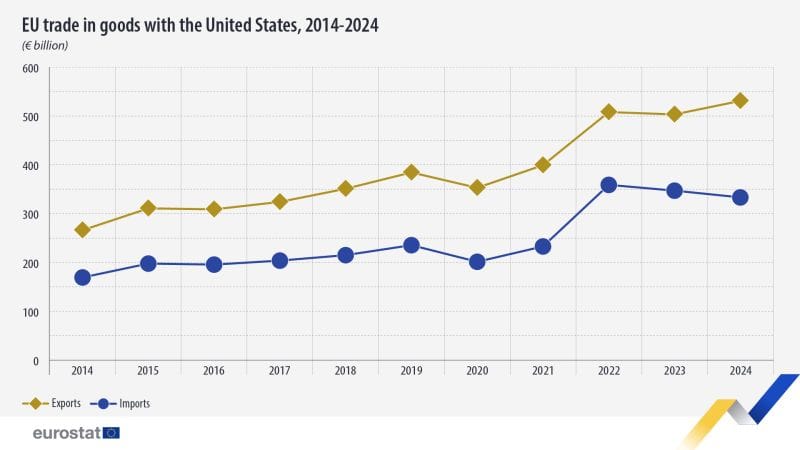

Why it matters: Tariffs threaten to dramatically increase prices on goods from both economies. Total US-EU trade is presently valued at almost $1 trillion ($606B imports, $370B exports, per the US Census Bureau).

- EU officials estimate that the US is currently applying tariffs to about 70 percent of the EU's exports to the US. President Trump has threatened a 50 percent duty on all US imports from the EU if an agreement is not reached.

- The EU has prepared a list of retaliatory duties covering €21B of US exports, and is preparing an additional list covering €95B of US exports. Total coverage: one-third of US exports to the EU.

What's the holdup?

Both sides face significant obstacles to concluding a deal within the next seven days:

Political optics: EU negotiators are limited in what terms they can accept due to pressure from 27 member countries.

- Some leaders such as German Chancellor Friedrich Merz and Italian Prime Minister Giorgia Meloni are advocating for sprinting to a preliminary agreement that will give quick relief to industries such as automobile manufacturing, leaving the details to be discussed later.

- Other EU officials have characterized US proposals as one-sided and want to avoid the appearance of having capitulated to President Trump, after previously promising to take a hard line against US "bullying."

- US President Donald Trump (June 16, 2025)

Scope of talks: The US has tried to keep both the 10 percent "baseline" reciprocal duties and sector-specific tariffs out of talks, but this is unacceptable for many EU officials.

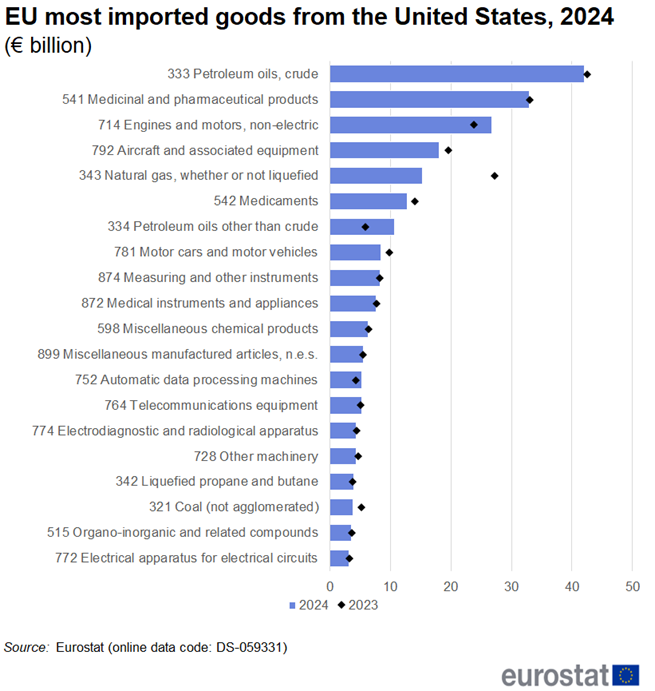

- Some EU officials publicly said they will refuse any deal that does not reverse the 10 percent duties or does not address sector-specific duties on steel, aluminum, and automobiles, and potential future duties on products like pharmaceuticals, semiconductors and aircraft.

- Bloomberg reports that Brussels is now prepared to accept a deal that includes the 10 percent duties, but not one that lacks US commitments on sector-specific tariffs.

The elephant in the room: US demands that the EU harden its economic and security policies against China continue to face roadblocks.

- Some EU members, such as Spain, want closer ties with China.

- Many EU politicians still see China as a lucrative export market, despite years of Chinese discrimination against imports. Some, such as French President Emmanuel Macron, advise against taking sides between the US and China in order to maintain the EU's leverage with both players.

- EU officials also say that the US's demands infringe on the EU's sovereign right to determine its own regulations. European Commission President Ursula von der Leyen has called certain topics "absolutely untouchable" and has argued that "where it is the sovereign decision-making process in the European Union and its member states that is affected, this is too far."

While von der Leyen has emphasized that the EU's approach to China is de-risking, not de-coupling, she also acknowledged the shared challenge posed by China to both the EU and the US:

...[T]he sources of the biggest collective problem we have has its origins in the accession of China to the WTO in 2001.... China has largely shown [its] unwillingness to live within the constraints of the rules based international system.

While others opened their market, China focused [on] undercutting intellectual property protections [and] massive subsidies with the aim to dominate global manufacturing and supply chains.

This is not market competition – it is distortion with intent. And it undermines our manufacturing sectors."

- European Commission President Ursula von der Leyen, at the G7 Meeting in Kananaskis, Alberta (June 15, 2025) (emphasis added)

What's next?

Three possible scenarios:

- a preliminary deal,

- no deal but an extension, or

- no deal followed by a tariff escalation.

Scenario 1: The US and EU reach a 'framework' deal by July 9th. (30 percent)

A preliminary framework is the best possible outcome before July 9th. Like the US-UK framework, a US-EU framework agreement need not exceed a few pages and would provide near-term relief for US and EU exporters and a political win for President Trump.

However, an impasse on US-EU policy alignment and sector-specific tariffs make even an agreement in principle by July 9th uncertain.

- The EU wants broad exemptions to the US's sector-specific tariffs, but the US cannot grant the exemptions while also preventing China from exploiting them and effectively incentivizing new US manufacturing investment.

- The US granted the UK sector-specific tariff exemptions, but US-UK economic and security policy alignment featured prominently in that framework.

- The EU has argued that allowing the US to influence EU regulations and standards would set an unacceptable precedent and violate EU sovereignty.

Scenario 2: No deal by July 9th, but the US extends the deadline. (50 percent)

US-EU disagreements and differences between EU member states on what they will accept suggest that even a preliminary framework may be out of reach before July 9th. However:

- Both sides now view each other as negotiating in good faith - after President Trump's threat of 50 percent duties several weeks ago lit a fire under EU negotiators.

- US Trade Representative Jamieson Greer said the EU offered a "credible starting point" for talks.

With hundreds of millions of dollars in US exports at stake, the US is unlikely to derail talks with tariffs as long as progress is being made, but it is not unusual in trade negotiations to save the thorniest problems for last.

- US Treasury Secretary Scott Bessent (June 11, 2025)

Scenario 3: No deal by July 9th, and the US raises tariffs. (20 percent)

Some EU politicians continue to favor taking a hard line with the US.

- They have signaled that they are open to a "zero-for-zero" tariff deal but will not accept any deal that leaves the US's new 10 percent tariffs in place, and that does not also lead to US concessions.

- These leaders are not driving US-EU negotiations, but they can block a settlement.

- More conciliatory voices such as President von der Leyen have also emphasized that retaliatory duties are still on the table, should negotiations fail.

If the US applies 50 percent tariffs to the EU, the EU will likely deploy its pre-determined retaliatory tariffs in response. The US would likely respond to any retaliatory tariff "rebalancing" with an escalating tit-for-tat series of tariff increases - similar to the administration's response to China's retaliatory duties in April.

The takeaway:

- Wall Street has priced in successful trade deals, but businesses should remain wary. A meaningful US-EU deal will be particularly challenging.

- A US-EU tariff escalation would ultimately lead to a truce and a fresh round of talks, but companies dependent on US-EU supply chains should take the near-term risk of prohibitively high tariffs seriously.